Reading time: 6 minutes

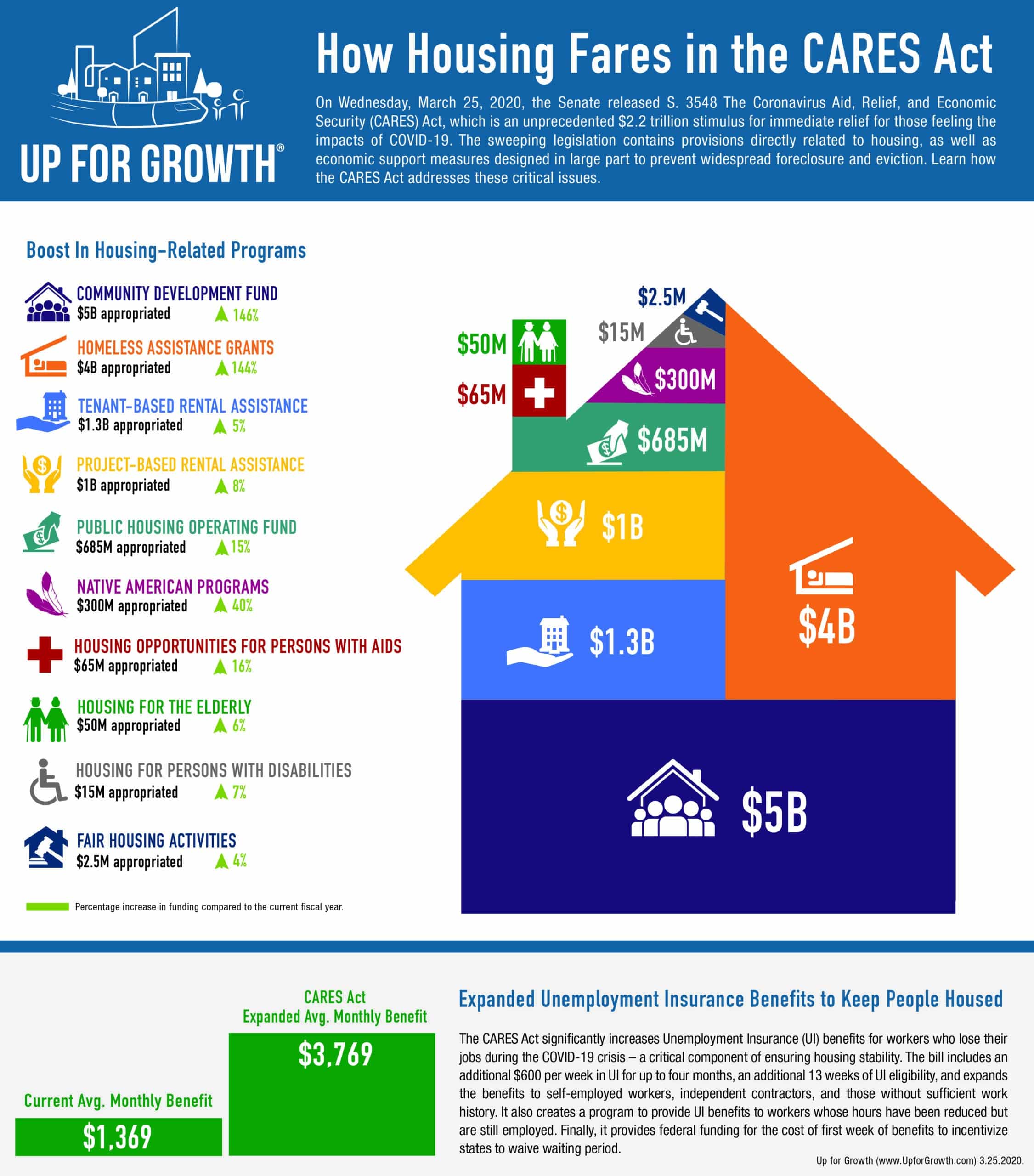

The stimulus legislation also contains billions in direct funding for housing programs to meet the needs of the most housing insecure. Highlights include $5 billion for the Community Development Fund, $4 billion for Homeless Assistance Grants, and a total of $2.3 billion for both tenant and project-based rental assistance. The CARES Act provides a 15% increase to the Public Housing Fund, while also appropriating monies for Native Americans, persons with AIDS, the elderly, and persons with disabilities. You can see how this funding breaks down in an infographic Up for Growth Action developed and is available on our COVID-19 page.

While this funding is certainly needed and a welcome development, perhaps the most important housing-related provision is the significant boost in UI. As we wrote in a letter to Congressional leadership last week, one of the most effective way to ensure that people can stay in their homes – whether they rent or own – is to give them a financial backstop to account for potential loss of income. Boosting and expanding eligibility for UI benefits efficiently gets money into the hands of the people who need it most, whether for housing costs or other expenses. This money also helps stabilize the housing ecosystem as landlords, owners, and lenders depend on rental and mortgage income.

The CARES Act expands UI benefits by $600 per week, for an average benefit of $3,769 per month; Up for Growth Action’s recommendations included a maximum of $4,000 per month in UI benefits. The increased benefit can last for up to four months, and is now available to the self-employed, independent contractors, and other workers including those who otherwise wouldn’t have enough work history to qualify for UI and workers who are providing care to family members diagnosed with COVID-19. The legislation also creates a program for workers who have had their hours reduced but have not been laid off to access UI benefits, which will help the millions of hourly workers not technically unemployed but are nevertheless struggling as a result of COVID-19.

Assuming the House of Representatives passes the CARES Act and President Trump signs the legislation, the first round of COVID-19-related stimulus likely draws to a close. Indeed, Senate Majority Leader Mitch McConnell is adjourning the Senate until April 20, and House Majority Leader Steny Hoyer has made it clear he does not want to call Members back until there is legislation on which to vote. In fact, Speaker Pelosi is hoping the CARES Act passes on voice vote to prevent the need for Members of Congress to gather in large numbers, which violates public health recommendations. This new reality doesn’t mean that Members and their staffs aren’t working, but it does mean we likely won’t see the final versions of additional legislation for several weeks (barring significant on-the-ground changes).

As it relates to housing, it is quite possible that additional support will be needed, especially if the economy remains effectively shut down for longer than a month or two. In last week’s insights post, I noted that several states and local governments have already taken action to prevent eviction and foreclosure, and federal agencies have taken their own steps to prevent foreclosure and provide loan forbearance as long as property owners do not evict their tenants during the COVID-19 crisis. Some states are declaring construction workers essential and exempting them from stay-at-home orders – a critical measure to ensure that the country doesn’t fall deeper into a housing deficit and a policy supported by Up for Growth Action.

Anticipating additional housing needs, Representative Denny Heck introduced the Emergency Rental Assistance Act that will boost the Emergency Solutions Grant (ESG) program by $100 billion to provide rental assistance to low-income Americans, as well as some moderate income Americans by increasing the eligibility to up to 80% of area median income. You can read our support letter on the Emergency Rental Assistance Act here.

It’s clear the country’s response to COVID-19 is a marathon, not a sprint. However, with the crisis escalating at lightning speed, the beginning of this race looked much closer to a 100-meter dash. Up for Growth Action will continue sprinting towards the distant finish line to ensure that the fallout from COVID-19 does not deepen our already severe housing supply and affordability crisis.